In Part 1 and Part 2 of this blog series, we discussed developing a mindset as individuals and teams to challenge the status quo and experiment. Those posts’ objective was to develop a culture that encourages teams to constantly seek incremental value in everything you do. In the third part of this series, we’ll discuss some practical considerations when capturing valuable and relevant Talent Intelligence (TI). While there’s no silver bullet because relevance varies so widely across our clients’ industries and focus, this post will include some ideas relating to TI capture in Invenias in the hope that it will help you discover what’s possible.

The rise of Talent Intelligence functions in some of the most progressive businesses in various industries is a recognition of the fact that the movement of talent precedes market movements. Gaining insight into trends in the markets you are serving is an incredibly valuable point of differentiation. The subtle signals from simply identifying what and where companies are hiring can give very early indications of changes in the strategy within businesses. We've had the opportunity to talk to many people who are doing this well, but recognize they are only scratching the surface. So we have little doubt that there is a great opportunity for those businesses who are willing to experiment with the collection and leveraging of TI to address broad business challenges beyond just hiring. This "trading in secrets" can be a truly unique differentiator for businesses but is rarely an asset that’s fully leveraged or systematized in Executive Search.

HUMINT Versus OSINT

Intelligence gathered by means of interpersonal contact is generally referred to as Human Intelligence or HUMINT. This is the bread and butter of most research teams, therefore a lot of people would assume that this activity sits exclusively within a small part of your organization. But the truth is that every single conversation with every single person in the industries you serve is an opportunity to gather HUMINT, the question is, are you organizing its collection and leveraging it? The lack of adoption amongst the more senior personas across our client base indicates that there are massive missed opportunities; not all of the intelligence that’s being gathered is being made available to everyone in a firm.

The alternative to HUMINT is OSINT (Open-Source Intelligence). LinkedIn is an obvious source of this for the Executive Search industry, but this can include hundreds of free or paid-for sources of data. The big question around OSINT is, how can it differentiate you given that open-source intelligence is available to everyone by its nature? In reality, applying a layer of human intervention will make it more relevant for the work that you do, such as translating the taxonomy of the sources of data you are accessing into something that improves that data.

The Death of the Org Chart

Earlier in the series, we talked about experimentation and killing experiments. A lot of data ages as soon as it’s collected and it can take a huge amount of effort to keep it up to date. Org charts are a great example of this—never more so than right now, with organizations changing shape every day. We have dozens of customers who have started to digitize information like org charts and have realized how much effort it then takes to maintain the accuracy and value of this data. This has resulted in many companies thinking about the value they get from this data, balancing the equation of effort versus value for the first time.

LinkedIn is constantly evolving the data it asks its users to volunteer about themselves and the people they know. A recent change has been the introduction of the Teammates feature. Increasingly, when providing recommendations or making connections, you can expect to see this activity accompanied by questions about whether the other person reports to you, manages you, or is a peer. But even with their reach, relying on a source of data around organizational structure will require some significant work in standardizing job title taxonomies. Doing this between departments in a single company is hard enough, let alone between companies. Especially when that data is being provided by 250M active users who could each interpret the questions in different ways. That's probably why LinkedIn is being coy about how and when they will be productizing this data set, though be sure they’ll inevitably try. That data will then become an OSINT source available to everyone so will surely diminish further any perceived value companies extract from their own sources of organizational structure.

Buy Versus Build

So what do you think about when paying for access to sources of OSInt? Any data you buy will rarely be perfectly segmented so that you can draw true meaningful insight from it. Think of the categorization of industry on LinkedIn; it’s nowhere near granular enough for most of the specialists we see using our platform. So a researcher often resorts to keyword searching, which will throw up a lot of false positives when searching. This means that you spend longer reviewing search results to find the relevant people. Customizing categories and building that data set so that it is a perfect fit for the industries you serve drives huge efficiency in searching alone but relies heavily on the formation of good habits to check and update this data with every interaction.

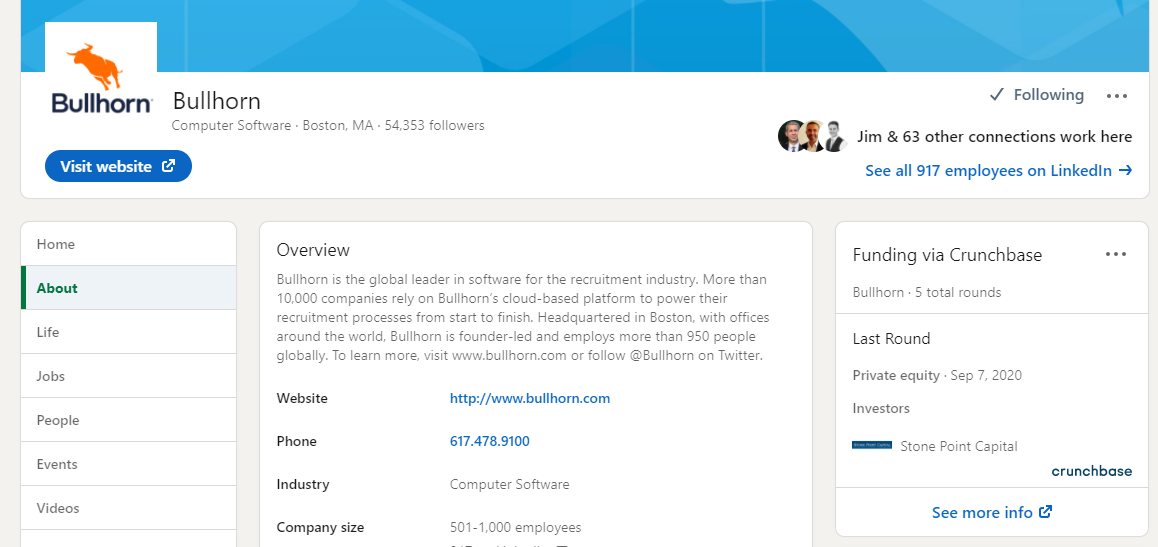

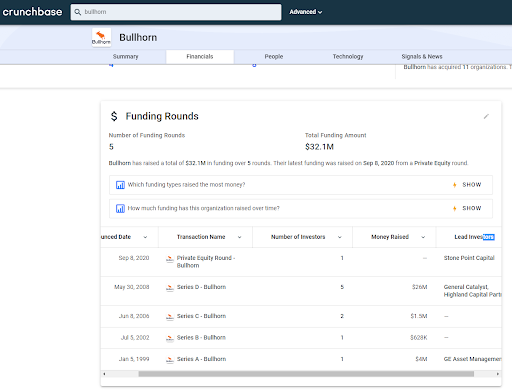

There can be some useful sources of data that businesses will purchase. Take Crunchbase as one example of this; this platform has always had a freemium approach with a paid-for subscription giving you access to significantly more data than a free account. But their data is now also being served up in LinkedIn Company Profiles. This sort of licensing of data is going to happen more and more. If you’re buying this data, so can everyone else. If you're simply accessing the same data that everyone else is, there’s no secret to trade in. Even if you happen to be one of the first to discover a source of insight, it will rarely be a differentiator for long as it becomes mainstream quite quickly.

Another issue when buying data is that the data you are paying for rarely comes with a "Best Before" date; however, it often ages and spoils quite quickly. Think about salary survey data, for example. It can take a year for a company to gather the data, and then they’ll typically sell it for a year, so you could be dealing in data that’s two years out of date. So the question you should always ask is, what's the expiration date on this data, and can we build and maintain something ourselves in a more agile way to keep that data fresh? The data set that you gather is likely to be smaller than some external sources, but you will be in full control of making sure that data perfectly fits your business requirements and is therefore always up to date.

Above we’ve discussed:

- Categorizing data, so you can easily segment your database in meaningful ways

- Capturing intelligence on companies, including relationships to other companies such as investors

- Capturing OSINT (e.g., work history) data to improve its relevance for your business

- Compensation/Remuneration data that’s specific and segmented for your business

Here’s a short video that looks at a set of features that can help you capture and leverage such data.